Small Business Tax Deductions 2024

Small Business Tax Deductions 2024 – If you’re a business owner, don’t overlook some of these easy small business tax deductions that could help improve your bottom line. . Small businesses complete their tax forms by reporting income and expenses. All deductions are reported under business expenses on Schedule C or C-EZ. Schedule C is normally used for deductions .

Small Business Tax Deductions 2024

Source : www.freshbooks.com22 Small Business Tax Deductions Checklist For Your Return In 2024

Source : www.insureon.com18 most important small business tax deductions for 2024

Source : ramp.comSmall Business Tax Deductions Checklist 2024 Blog Akaunting

Source : akaunting.com7 Tax Deductions for Small Businesses in 2024

Source : www.billdu.comAmazon.com: Small Business Taxes Mastery 2024: A Step by Step

Source : www.amazon.comSmall Business Expenses & Tax Deductions (2023) | QuickBooks

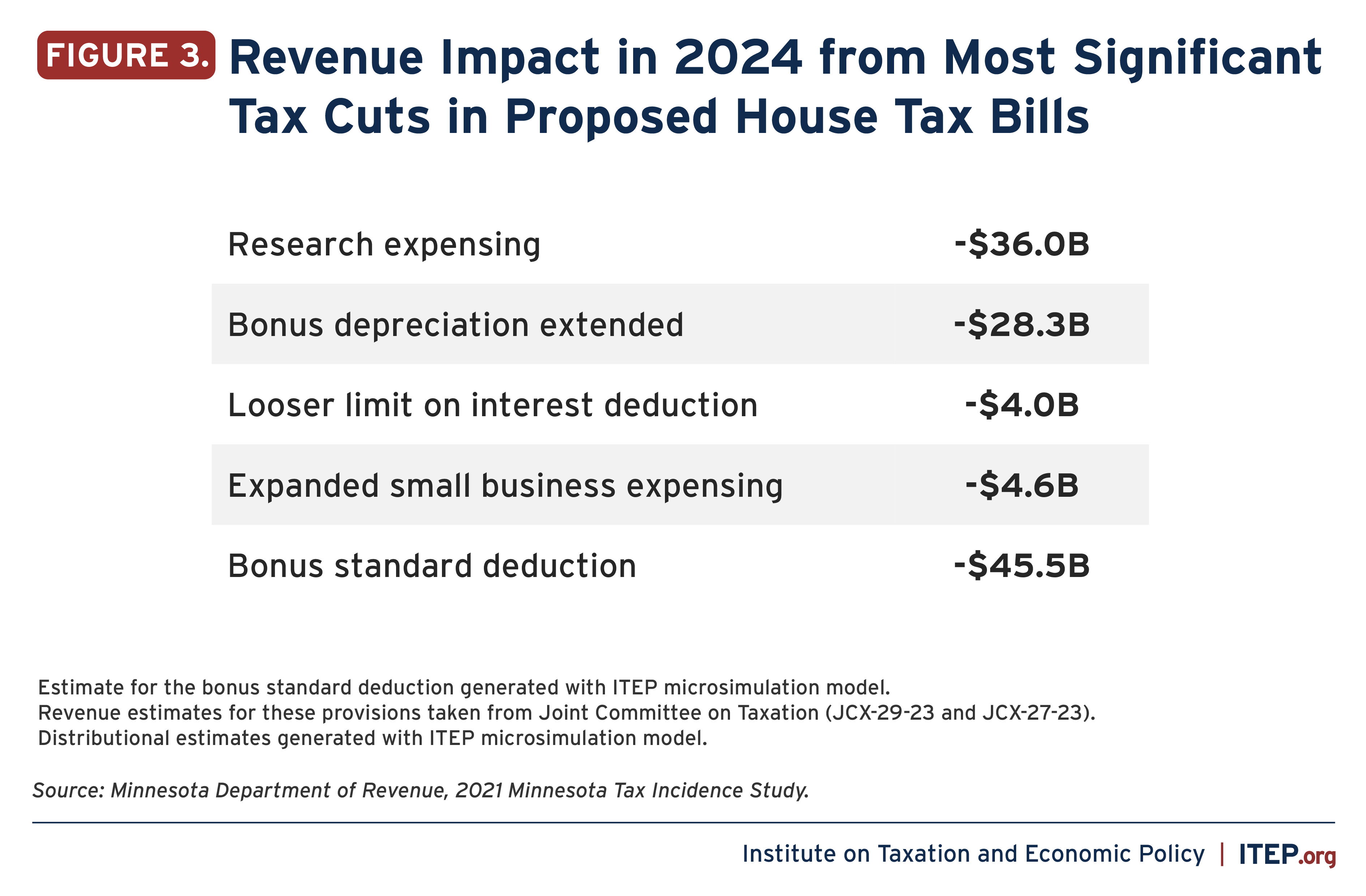

Source : quickbooks.intuit.comTrio of GOP Tax Bills Would Expand Corporate Tax Breaks While

Source : itep.org2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.orgAmazon.com: Lower Your Taxes BIG TIME! 2023 2024: Small Business

Source : www.amazon.comSmall Business Tax Deductions 2024 25 Small Business Tax Deductions To Know in 2024: As a small business owner, you typically need to spend money to make money. The upside? You can deduct qualifying business expenses on your taxes to lower your overall tax liability. But how do . Discover how self-employed individuals and employees can claim cellphone expenses as a tax deduction, and how the rules have changed over the years. .

]]>